SBI Internet Banking is a service offered by the State Bank of India (SBI) that allows customers to conveniently manage their accounts and perform various banking transactions online. It provides a secure and user-friendly platform for SBI account holders to access their accounts anytime, anywhere, using a computer or mobile device with internet connectivity.

Key features and benefits of SBI Internet Banking include:

- Account Management: View account balances, transaction history, and download account statements.

- Funds Transfer: Transfer funds between SBI accounts, other bank accounts within India, and international accounts.

- Bill Payments: Pay utility bills, credit card bills, and make mobile/DTH recharge.

- Online Shopping and Investments: Make online purchases and investments in mutual funds, bonds, and more.

- Loan and Credit Card Services: Access and manage loan accounts, credit card statements, and make payments.

- Personalized Alerts and Notifications: Stay informed with real-time updates on account activity, transactions, and important announcements.

- Enhanced Security: SBI Internet Banking incorporates multi-factor authentication, secure login credentials, and encryption to ensure the safety of customer information and transactions.

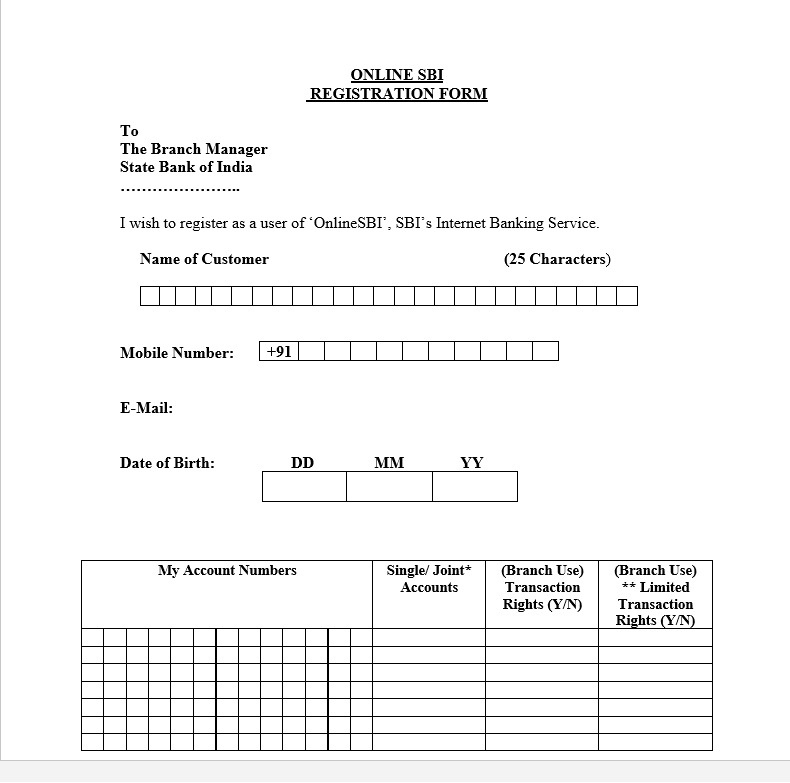

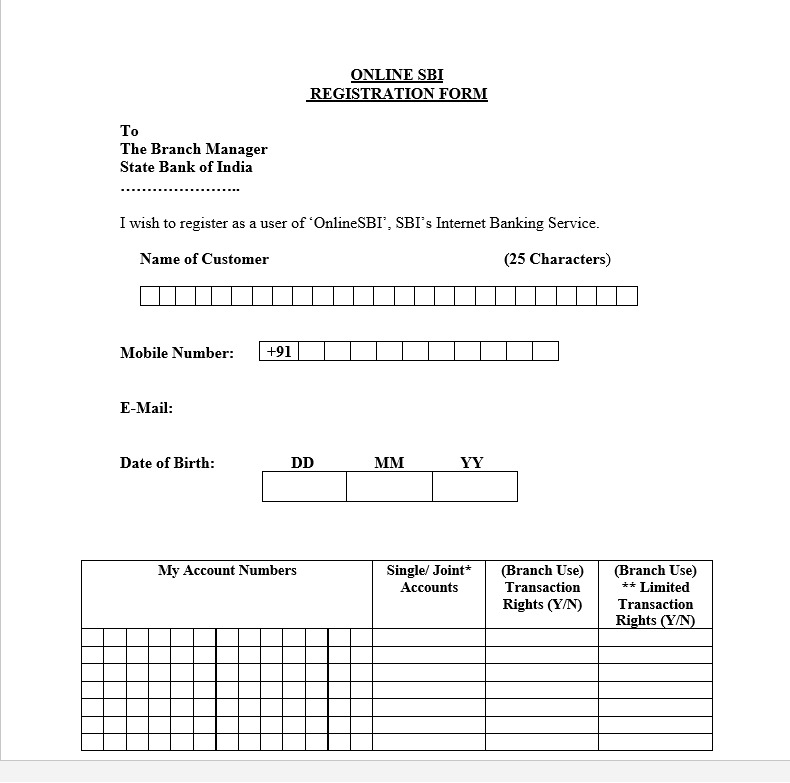

To avail of SBI Internet Banking, customers need to register and activate their accounts through the official SBI Bank website or by visiting their nearest branch. The registration process typically involves providing personal and account-related details, generating a username and password, and verifying the account ownership.

SBI Internet Banking enables customers to save time, avoid standing in queues, and perform various banking tasks at their convenience. It has become an essential tool for modern-day banking, providing customers with greater control over their finances and simplifying their banking experience.

+ There are no comments

Add yours